Quarterly market review: Q1 2023

By: Paul Dickson, Director of Research and Mark Stevens, Chief Investment Officer

Staying the Course

Speculation that the Federal Reserve will reverse course in its battle against inflation or change its policy target to a higher one is likely misplaced. A recession – hopefully a mild one -- is the most likely outcome with “policy triage” applied for unintended victims.

The Federal Reserve’s (Fed) monetary tightening program recently had its first birthday. On March 15, 2022, the Fed increased its Effective Federal Funds Rate (Fed Funds Rate) by 25 basis points and announced a slow unwind of its balance sheet of bonds bought to prop up the pandemic-stricken economy. Over the past year, inflation initially accelerated before starting to recede: the job market continued to strengthen, house prices surged, and consumer spending remained robust, which was often referred to as “revenge” against the Covid-era lockdowns. These events challenged the Fed to continue tightening policy far faster and further reaching than initially expected. In the wake of the most dramatic increases in interest rates in 40 years, many speculative sectors deflated – such as the decline in crypto assets such as Bitcoin, the failure of many so-called stable coins, and related firms such as FTX and BlockFi, among many. Mortgage rates surged, and while house prices have remained robust, sales volumes have slumped.

The first quarter of 2023 saw the most significant news-making and market-moving of these events, with the most extensive bank failures since the onset of the Financial Crisis 15 years ago. The sudden collapse of Silicon Valley Bank (SVB) and Signature Bank raised broad concerns that other small and regional financial institutions might face similar liquidity problems. As of this writing, the Federal Financial Institutions Examination Council estimated that the U.S. banking system has $620 billion in unrealized losses on its books. Those unrealized losses are largely the result of falling market prices on longer-term bond holdings as interest rates have risen over the past year. When SVB needed to raise capital by selling such bonds in its portfolio and realized those losses, it left the bank in an illiquid position and unable to meet depositors’ withdrawals, forcing the bank to fail.

The collapse of the two banks led the Federal Reserve, U.S. Treasury, and FDIC to establish protections for most deposits in those two as well as facilities to backstop other banks whose securities portfolios may be underwater on a mark to market basis. The Fed has agreed to provide loans against such securities so that banks can meet liquidity needs without realizing losses on their portfolios. These moves by the authorities amount to a kind of “policy triage” where emergency action is needed to stem more far-reaching impacts from surprises such as these. It remains to be seen if this will mitigate worries over the health of small and medium sized banks and slow the withdrawal of deposits from them in favor of larger banks, brokerages, and money market type investments. Of course, SVB and Signature were not the only banks in the news. Credit Suisse, a bank that has been ailing for some time, was taken over by long-time Swiss rival UBS. First Republic Bank faced its own liquidity crunch and was provided $30 billion in credit by rival institutions to keep the bank afloat through the market turbulence.

The worrisome banking news has led many Fed watchers, economists, and pundits to hypothesize that the Fed should stop its monetary tightening program to reduce pressures on the banking system. The concern here is that smaller and regional banks are of critical importance to the small and medium sized businesses that are the foundation of the U.S. economy. Any reduction in credit availability (in addition to the already occurring repricing) could cause a significant and quick slowdown. Already the bond market has moved from expecting several more rate hikes and a higher year-end Fed Funds Rate to pricing in rate cuts as early as this summer (chart below). Many strategists believe that the economy will either have been tipped into recession by the second half of the year or come quite close.

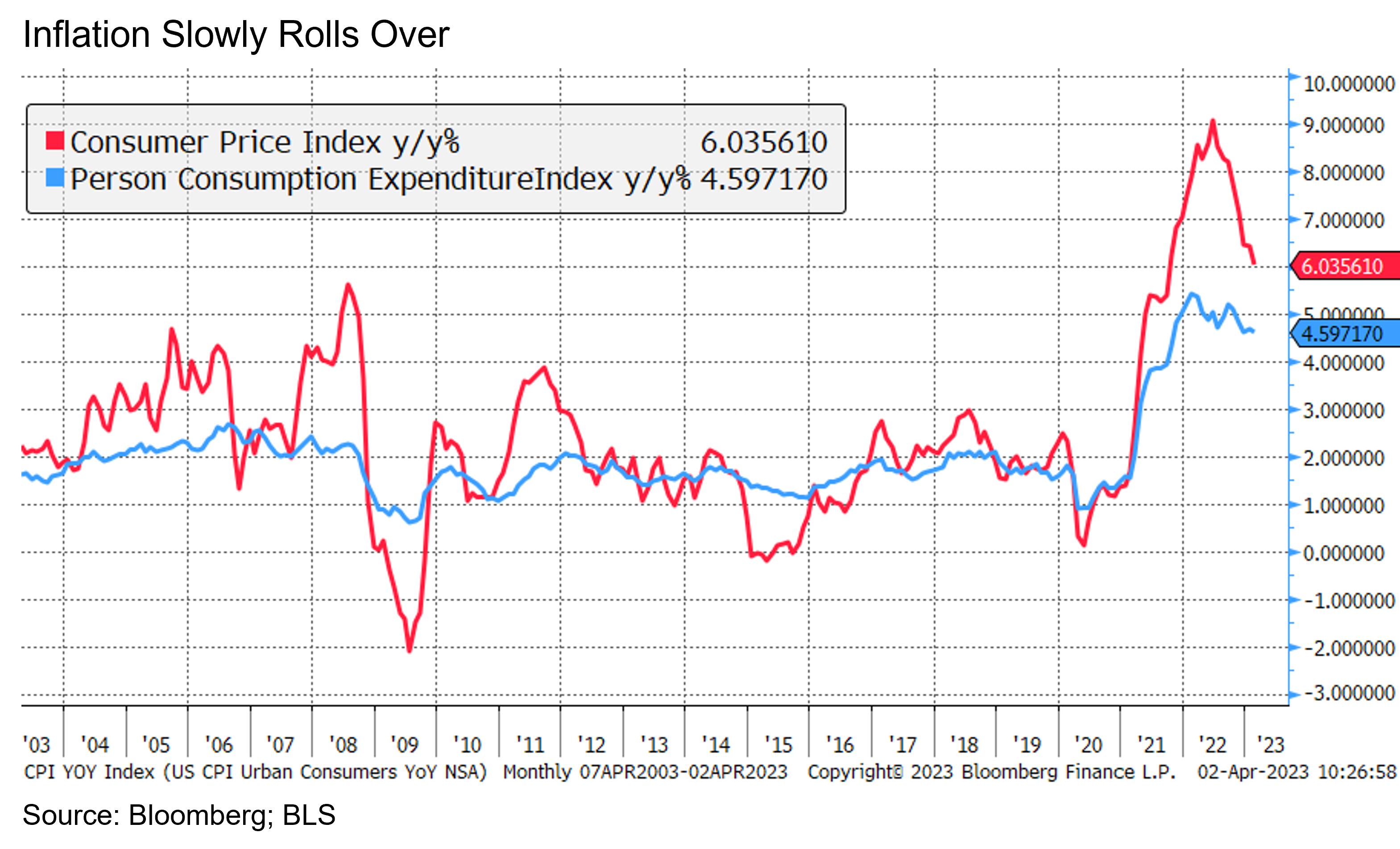

Some of these same observers believe that the actions the Fed has taken to date should suffice to bring inflation down over the coming months. Quite a few others have argued that the Fed should increase its inflation target because it will be difficult to reach 2%. Some point to the Fed having already brought its preferred measure (the Personal Consumption Expenditure Index) down to almost 4% (see Consumer Price Index) as a justification for declaring victory. A few have noted a previous statement by the Fed that its official inflation target was a “symmetrical 2%”, which could imply a range of 0%-4% with 2% being the midpoint for an inflation target.

Given that the Fed chose to hike its policy “Fed Funds Rate" by another 25 basis points on March 22 amid all the angst over the banking sector and it cautioned that an additional hike remains likely due to still worrying data, a change in the official target seems very unlikely.

“Until Something Breaks”

It is often said that it takes a full year for changes in monetary policy to have their full effect. Given that the present policy cycle is barely one year old, the impact of Fed moves will likely continue to appear. There is an old quip that goes: the Fed will tighten policy until something breaks. Presumably, the Fed is looking to break the back of inflation without undue pain to the rest of the economy. However, history tells a slightly more troubling story. In the early 1980s, the Fed broke inflation but also plunged the economy into recession and set off the Latin American Debt crisis as higher rates and generally tighter conditions made repayment of those governments’ debts impossible.

At the end of the 1990s and the onset of the aughts, rate hikes were blamed for deflating the stock market and bursting the dot-com bubble, and causing a recession. The hikes of 2004-2006 caused the housing bubble to pop and unleashed the Global Financial Crisis and Great Recession. The modest series of rate increases from 2016-2019 led to a significant stock market correction in late 2018 and a recession that might have been, had Covid not taken out the economy by itself. So far, nothing that has broken, from crypto coins and firms to a handful of banks, has threatened to derail the economy. A reset of excesses is necessary and healthy; an unintended shock is not.

For this reason, all eyes have turned to the commercial property market as the next most possible source of economic stress as investments are repriced to reflect higher interest rates but also the likely difficulties some segments will have as refinancing comes due. The sector’s slump deepens as credit conditions tighten, accelerated by the retrenchment of many smaller and mid-sized banks, which are the most involved in commercial loan finance. As U.S. Treasury Secretary Yellen remarked recently in a speech, the non-bank financial sector (atmospherically named “shadow banks”) has doubled its share of credit in the system over the past few decades, where traditional banks have remained relatively flat. These firms are heavily involved in real estate, especially since the Global Financial Crisis, where banks were curtailed from growing their balance sheets aggressively. These non-bank financial actors went all in at fire-sale prices and continued to grow from there. Cracks have begun to appear with some failed large commercial refinancings and a few real estate investment trusts (REITs) facing significant problems.

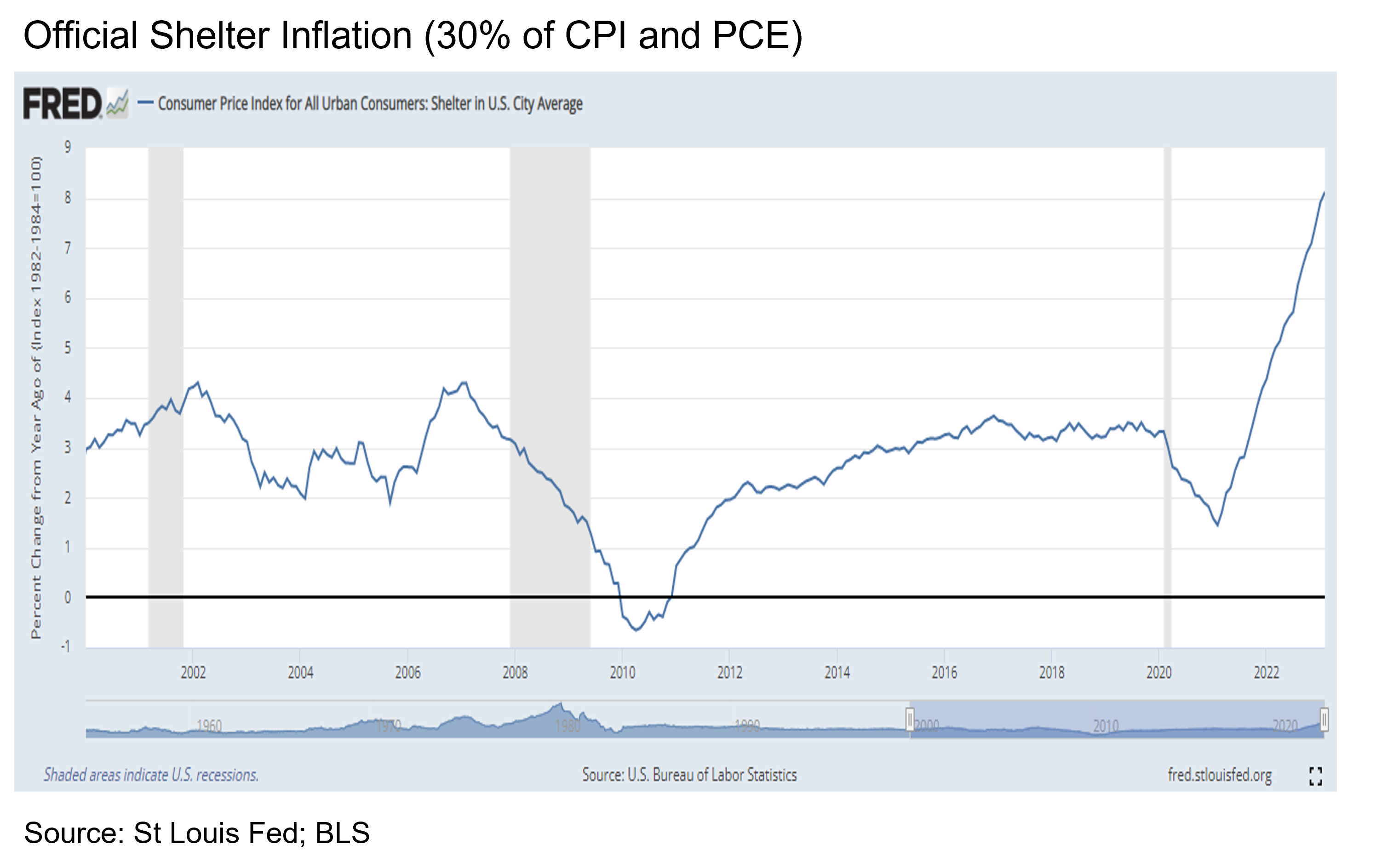

If problems in real estate investments become more acute, it could be a reason for the Fed to pivot on policy. As it stands, however, the Fed seems determined to see inflation drop to its targeted range, even if that means a recession. In terms of the data that continue to vex officials at the central bank, shelter inflation and continued strong wage growth in a tight labor market, threaten igniting the dreaded wage-price spiral that dogged the economy in the 1970s. Shelter price inflation is 30% of the inflation indices, and while it took some time to really take off, the official account shows shelter prices growing at 8% year-over-year

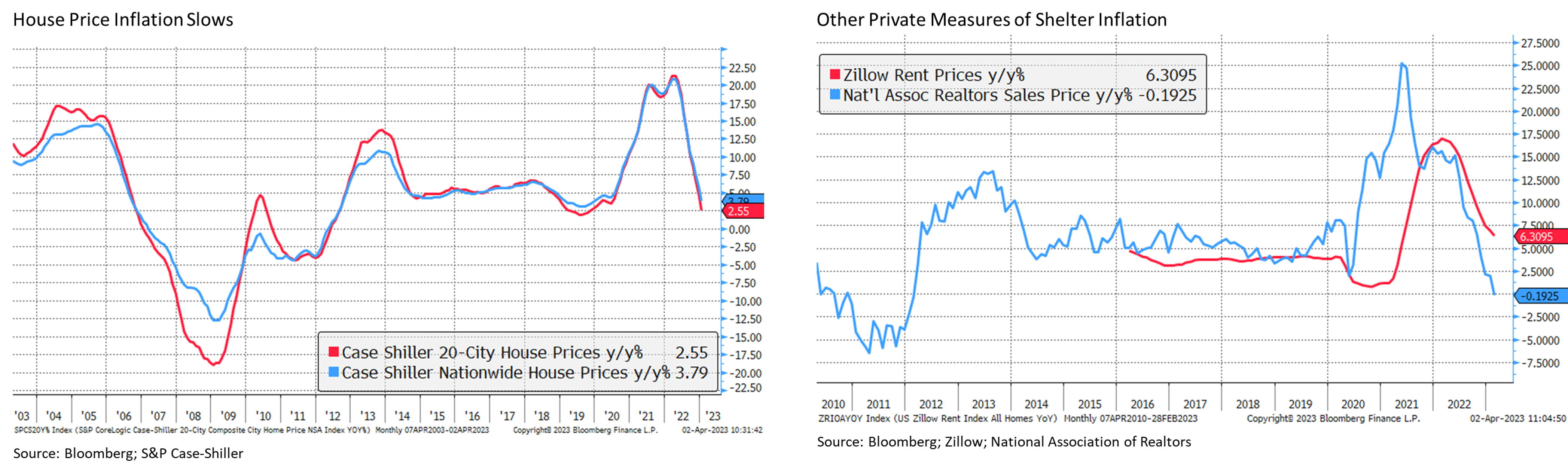

As the chart above shows, shelter price inflation as a component of the Consumer Price Index (CPI) has greatly increased. For those of us who worried about the housing bubble in the mid-2000s in advance of the Financial Crisis, this is the same statistic that failed to catch the phenomenon during that period. This is because the measure is of rents and owner implied rents, and not actual house prices. As Fed Chair Powell has noted, the Fed recognizes that this can be a significantly lagging indicator as rents tend to be negotiated for a year at a time. Even if they are stagnating or falling presently, that will only show up with a lag. Private measures of shelter inflation paint a significantly different picture and could well play into Fed thinking.

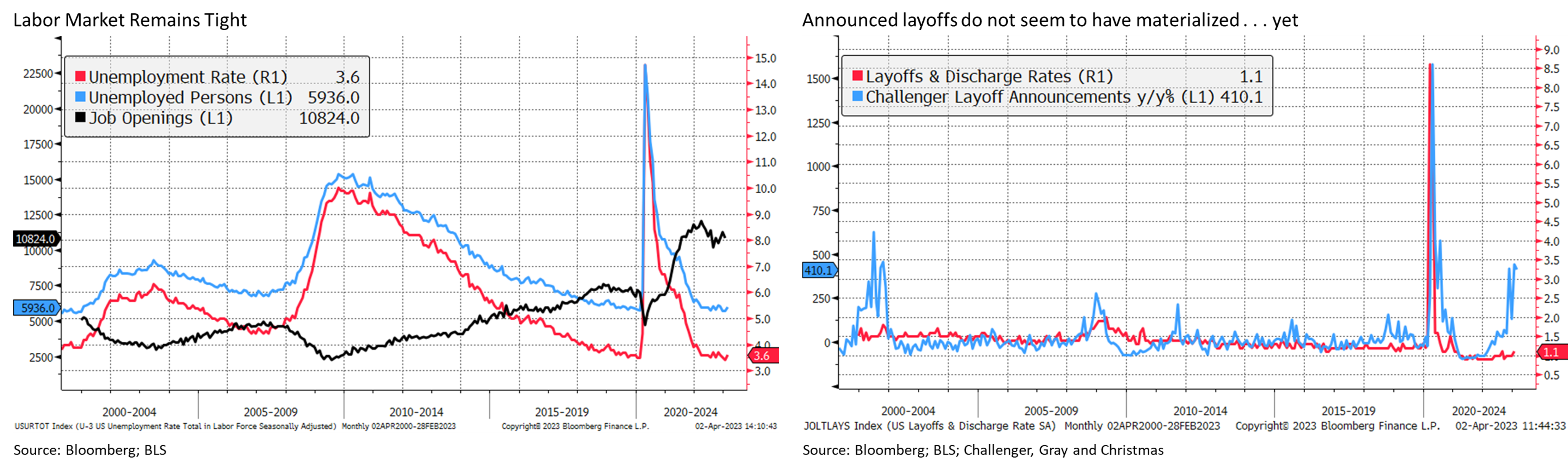

In terms of wages, which are not measured in the CPI or Personal Consumption Expenditures Price Index (PCE), both the Atlanta Fed Wage Tracker and the Average Hourly Earnings from the Bureau of Labor Statistics (chart above) show a slowing of year-on-year growth. However, they remain elevated compared with what the Fed would like to see. As noted during testimony earlier in the month as well as during the post Federal Open Market Committee (FOMC) press conference, the Fed expects unemployment to rise over the coming months as the labor market softens. The data does not show this taking place. Payroll additions remain robust, job openings remain elevated, and the unemployment rate is barely up from a 50+ year low.

labor market softens. The data does not show this taking place. Payroll additions remain robust, job openings remain elevated, and the unemployment rate is barely up from a 50+ year low.

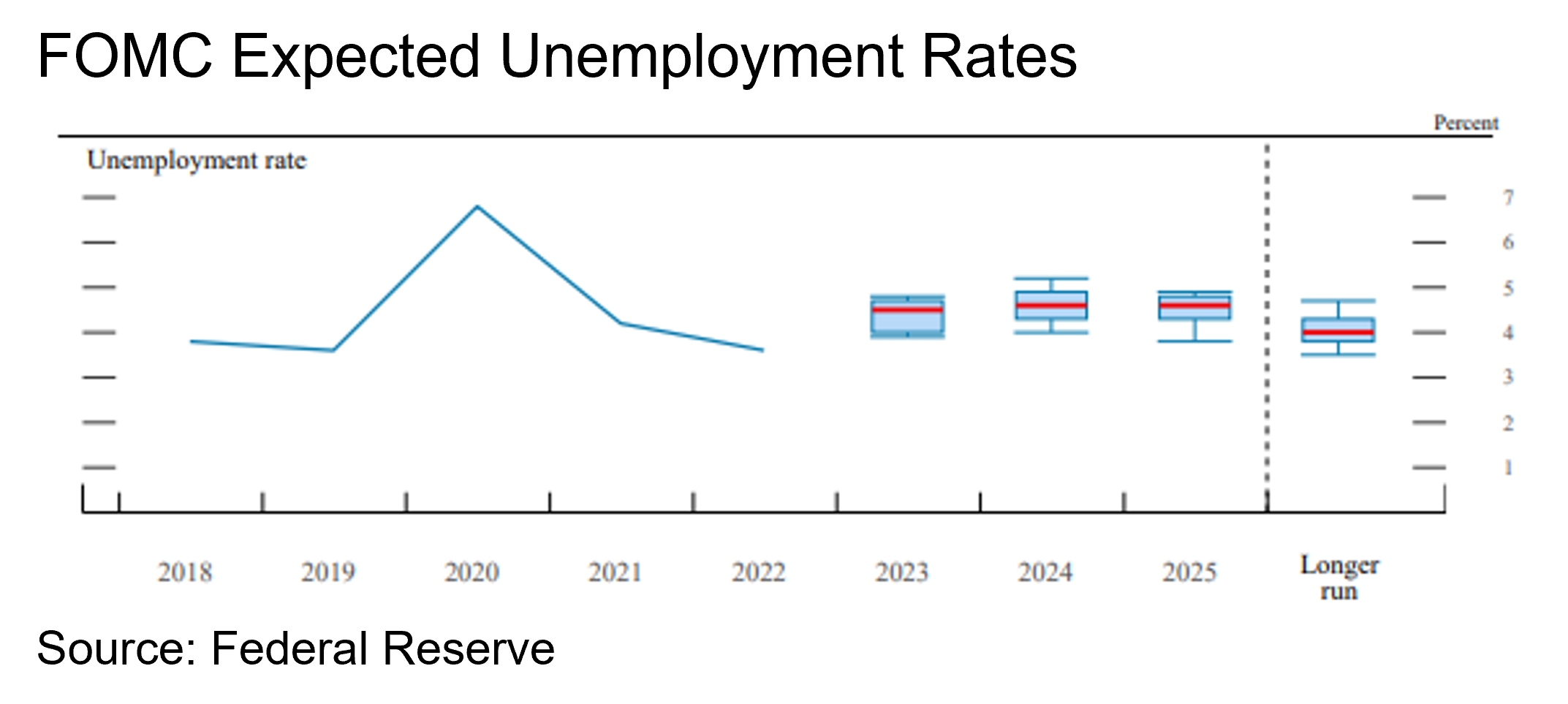

This is the final dilemma for policymakers. It seems they have concluded that the current level of unemployment is too low to accommodate their inflation target and that a softening there should follow the tightening of monetary policy.

The chart shows Federal Open Market Committee members’ expectations for unemployment trends over the coming few years and over the longer run. The average is for unemployment to rise a full percentage point by the end of the year (red mark inside blue range of expectations). Such a decline in employment has usually been accompanied by – if not caused by -- a recession.

The recovery in asset prices during the first quarter of the year favored many of the same growth stocks that had strongly underperformed last year. That show of confidence seems to under-appreciate any additional risks to the economic outlook, including the still present risk of a recession, even if it turns out to be mild. This could mean that we just experienced a “bear market rally” and will see a reversal at some point this year. Even if this is not the case, we would still favor value stocks as a better investment for where we are in the economic cycle.

Our recommendation is to invest in fixed income paid off in the quarter as there was also a recovery in bond prices. There are still good opportunities bonds on a relative value basis, especially in higher credit quality names and U.S. Government issues as yields remain elevated compared to the recent past. It is probably too early to add low grade junk bonds in any meaningful size as the economic outlook remains uncertain. Outside of the U.S., our recommendation for diversifying into developed international equity markets has performed quite well. We think we still have significant upside potential from here. The dollar remains strong against other currencies, but that relationship is likely to revert, at least to a degree, providing an additional source of return for U.S. based investors.

Looking back over the past year and considering how well diversified investments outside of traditional stock and bond markets performed, we remain committed to having them as a regular feature for managing money. Not only did they outperform in a down market, but they also lowered the overall riskiness of our portfolios. Consider the same for your investments. Diversifiers can include income generation opportunities outside of the bond market, or they can provide a way to hedge downside risk in portfolios without sacrificing too much upside potential.

Wealth Management does not provide accounting, legal or tax advice. This information discusses general economic and market activity and is presented for informational purposes only and should not be construed as investment advice. Views and opinions expressed herein do not account for any specific investment objective, restrictions, and/or financial circumstances of any specific client. Investors are urged to consult with their financial advisors before buying or selling any securities.

Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. The investment return and principal value of investment securities will fluctuate based on a variety of factors, including, but not limited to, the type of investment, amount and timing of investments, changing market conditions, currency exchange differences, stability of financial and other markets, and diversification. The statements and opinions expressed in this article herein are those of the author as of the date of the article and are subject to change. Content and/or statistical data may be obtained from public sources and/or third-party arrangements and is believed to be reliable as of the date of the article.

Products offered through Wealth Management are not FDIC Insured, are not bank guaranteed and may lose value.