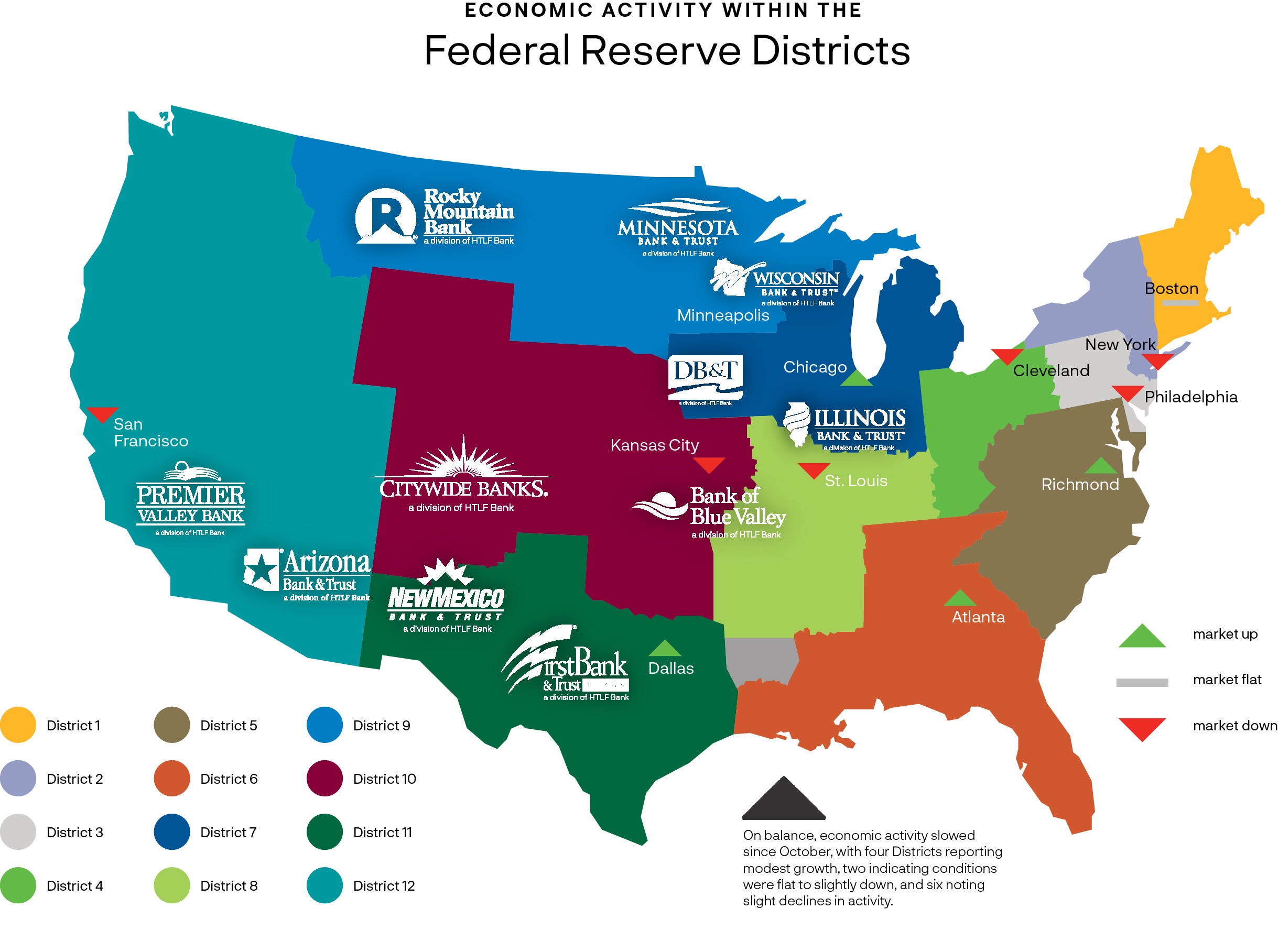

Commonly known as the Beige Book, this report is published eight times per year. Each Federal Reserve Bank gathers anecdotal information on current economic conditions in its District through reports from Bank and Branch directors and interviews with key business contacts, economists, market experts and other sources. The Beige Book summarizes this information by District and sector. An overall summary of the twelve district reports is prepared by a designated Federal Reserve Bank on a rotating basis.

Overall Economic Activity

Retail sales, including autos, remained mixed; sales of discretionary items and durable goods, like furniture and appliances, declined, on average, as consumers showed more price sensitivity. Travel and tourism activity was generally healthy. Demand for transportation services was sluggish. Manufacturing activity was mixed, and manufacturers’ outlooks weakened. Demand for business loans decreased slightly, particularly real estate loans. Consumer credit remained fairly healthy, but some banks noted a slight uptick in consumer delinquencies. Agriculture conditions were steady to slightly up as farmers reported higher selling prices; yields were mixed. Commercial real estate activity continued to slow; the office segment remained weak and multifamily activity softened. Several Districts noted a slight decrease in residential sales and higher inventories of available homes. The economic outlook for the next six to twelve months diminished over the reporting period.

Labor Markets

Demand for labor continued to ease, as most Districts reported flat to modest increases in overall employment. The majority of Districts reported that more applicants were available, and several noted that retention improved as well. Reductions in headcounts through layoffs or attrition were reported, and some employers felt comfortable letting go low performers. However, several Districts continued to describe labor markets as tight with skilled workers in short supply. Wage growth remained modest to moderate in most Districts, as many described easing in wage pressures and several reported declines in starting wages. Some wage pressures did persist, however, and there were some reports of continued difficulty attracting and retaining high performers and workers with specialized skills.

Prices

Price increases largely moderated across Districts, though prices remained elevated. Freight and shipping costs decreased for many, while the cost of various food products increased. Several noted that costs for construction inputs like steel and lumber had stabilized or even declined. Rising utilities and insurance costs were notable across Districts. Pricing power varied, with services providers finding it easier to pass through increases than manufacturers. Two Districts cited increased cost of debt as an impediment to business growth. Most Districts expect moderate price increases to continue into next year.

Outlook Across the 9th District

Economic activity in the Ninth District was flat to down slightly since the previous report. Employment grew modestly, but job openings declined. Wage pressures were unchanged but ongoing wage growth remained above average, while price pressures were modest. Growth was noted in some areas of construction, but residential construction was slow, and manufacturing also fell slightly. Consumer spending was flat. Agriculture weakened as farm incomes softened, and energy exploration was unchanged. Minority- and women-owned businesses reported steady activity.

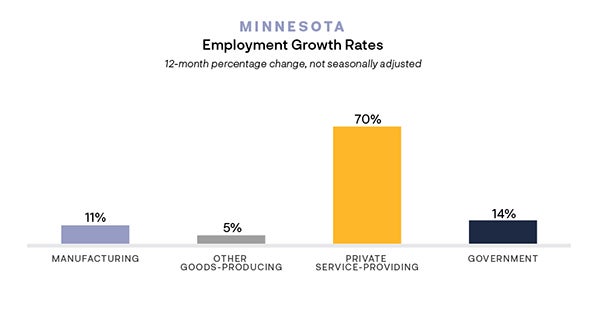

Labor Markets

Employment grew modestly since the last report. But there was variation among sectors, some of which had increased layoffs. Labor demand was positive overall but somewhat lower than earlier in the year. Some contacts reported that they were not replacing workers who had left, or were eliminating open positions. Strong labor demand was reported by health care and finance firms, while hiring sentiment was softer in other sectors, including manufacturing. More than half of construction contacts were hiring, though many were attempting to fill turnover; the share that was not hiring grew, and one in seven was cutting workers. Expected labor demand for the coming months was moderately positive overall. Among those planning to hire, a notable share cited overworked staff as an important factor for doing so.

Wage pressures were unchanged since the last report, but ongoing wage growth remained above average. A general survey of District firms found that about 30 percent were raising wages by more than usual, while a similar share reported raising wages by less than usual or not at all. A survey of construction firms found that about 70 percent had increased wages by at least 3 percent over the last year despite some evidence of recent sectoral slowing. Expectations of future wage increases were similar to the sentiment six months ago.

Prices

Prices pressures increased modestly since the last report. Slightly fewer than a quarter of firms responding to an October business conditions survey indicated that their prices charged to customers increased from the month prior, while 15 percent said they reduced their prices. A larger share reported that their nonlabor input prices increased. Administrative contacts reported an increase in the price of office supplies. A regional food producer said that milk and cheese prices declined recently. Retail fuel prices in District states decreased briskly since the previous report.

Consumer Spending

Consumer spending was flat since the last report. Recent sales tax receipts in Minnesota were flat month over month and year over year. Contacts reported that consumers have become more price sensitive for everyday goods, with growing purchases at low-cost retailers compared with premium ones. At the same time, sales of some big-ticket items remained healthy. A vehicle dealer with locations in multiple District states saw October sales rise by 10 percent over last year. A northern Wisconsin banker noted the disparate tendencies. “People are mad about eggs costing more, but they’ll still buy a car.” Other banking contacts noted increased use of credit card and home equity lines of credit to maintain spending levels. Tourism traffic in Michigan’s Upper Peninsula remained robust this fall. Hotel occupancy rates in Minnesota were notably higher than a year ago, and lodging and accommodation fees in Minnesota remained on par with last year’s record pace.

Worker Experience

In a recent survey, half of employed respondents expressed satisfaction with their current job, wages, and company culture. The other half of respondents were looking for new opportunities and hoping to increase their earnings, but they categorized potential opportunities as average at best. Job seeking respondents cited bad job options, lack of response from potential employers, and unreasonable skill or experience expectations as the top three factors preventing them from reaching their objectives. A worker highlighted that starting pay was “far too low” despite his experience in a variety of trades. Another worker expressed frustration with college education requirements, saying that “most companies are not willing to compensate for years of service without a degree.”

Manufacturing

District manufacturing activity decreased slightly since the previous report. Manufacturing respondents to an October business conditions survey reported decreased orders on balance relative to a month earlier, with expectations for a further decrease in the month ahead. A regional manufacturing index indicated increased activity in North Dakota and South Dakota in October from a month earlier, while activity decreased slightly in Minnesota. A custom manufacturer said recent sales “dropped like a rock.” One contact reported that because of the undersupply of workers to the sector, “thousands of unfilled jobs would need to be eliminated before anyone gets to layoffs.”

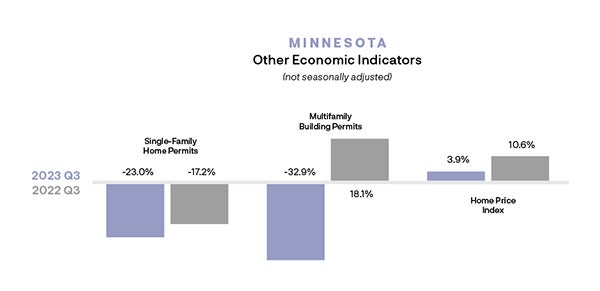

Construction And Real Estate

Construction and real estate activity decreased slightly on net over the reporting period. Residential construction was down slightly with demand for major remodeling projects falling substantially. According to a survey, homebuilders were more pessimistic about activity in the coming months than they had been earlier in the year. Residential real estate sales decreased slightly, while continued low home inventories supported a slight increase in prices and rents. Nonresidential construction activity was unchanged as were prices of new construction. Contacts again reported that high interest rates were forcing previously financially viable projects to be delayed indefinitely. Commercial real estate activity declined slightly, though vacancy rates and the availability of sublease space also fell. Prices and rents edged down. One contact reported that while leasing activity had held up, sales activity had fallen off.

Get Your Financial Feed Today

The Financial Feed is the premiere publication for banking insights. Each issue prioritizes strategies on how business leaders can continue to grow despite possible economic headwinds. We hope these findings help you conquer potential challenges and capitalize on opportunities.

Source: The Federal Reserve’s Beige Book

These links are being provided as a convenience and for informational purposes only; they do not constitute an endorsement or an approval by HTLF of any of the products, services or opinions of the corporation or organization or individual. HTLF bears no responsibility for the accuracy, legality or content of the external site or for that of the subsequent links. Contact the external site for answers to questions regarding its content and privacy rules.